THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Saving money doesn’t have to mean sacrificing your happiness.

Actually, picking up smart money habits can make life richer and more fulfilling without making you feel like you’re missing out.

Whether you’re saving for a big goal or trying to stretch your budget, there are many ways to cut costs without sacrificing your happiness.

In this article, we have 24 tips on the best ways to save money without sacrificing happiness that range from the classic to the unexpectedly different.

These are some ways that you can cut back on your spending without cutting out the things you love.

So grab a cup of coffee, preferably one you made at home instead of from a fancy coffee shop, and get ready to learn how you can save money and still enjoy life to the fullest.

#1. Make a Budget

The first step in saving money is to know where you stand and then make a plan.

A budget can help you keep track of your expenses and identify areas where you can cut back.

The good news is, you can be as detailed as you want. If this is your first budget and you are struggling with money, you probably want to track everything.

But, if you are doing financially OK, you can track specific categories to help you be a smarter spender.

#2. Cook More at Home

Eating out can be a major expense, especially if you’re someone who eats out often.

You don’t have to stop eating out altogether; you can opt to cook more meals at home and eat out only on special occasions. While the price of groceries has increased, the cost to eat out has risen even more. Even if you try to find cheap places to eat out, you are still going to spend a decent amount of money.

#3. Carpool

Saving on gas and car expenses is easy to do by carpooling.

Contact coworkers, friends, or family members who live nearby and start a carpool. Pick a day or two a week to start. You don’t have to commit to every day. Even a little bit helps out.

#4. Exercise Outdoors

Whether you take a walk, hike, or go to a local park to exercise, canceling your gym membership can easily save you money.

You can enjoy the beauty of nature while getting fit, so you are not sacrificing your happiness; instead, you are adding to it.

#5. Use Cashback Apps

Apps like Rakuten and Ibotta offer cashback on your purchases, giving you money to save on all your everyday purchases. In fact, there is no reason why you can’t use a coupon or get cash back on every online purchase you make.

Every little bit adds up and can be used towards your savings or for a special treat.

#6. Automate Your Savings

If you set up automatic transfers from your checking account to a savings account each month, you will never miss the money you are saving.

This automated process will help you reach your savings goals faster without having to think about it. Start small with $10 every other week. You’ll quickly realize you don’t even notice the money is not in your checking account.

After a few months, slowly increase the amount you save. Then make a reminder in your phone to increase the amount a little more in six months.

#7. Visit Thrift Shops

If you love to shop, you don’t have to stop; just change where you shop.

Shopping at thrift stores is a great way to enjoy your shopping trip without breaking the bank.

#8. Stop Subscriptions

It’s easy to sign up for subscriptions and forget about them, so you won’t miss them if you are not even using them.

Take a look at all of your subscription services and cancel the ones you no longer use or need.

#9. Seek Out Free Entertainment

There are lots of ways to have fun activities without spending money, from community activities to family game nights.

You can even plan a fun backyard camping trip with your family and friends or have a movie night at home with homemade popcorn. A cheap projector and a white bed sheet is all you need!

#10. Buy in Bulk

You’ll find that buying in bulk can save you money in several ways, including spending less on items in the long run.

You will also reduce your trips to the store, and you can also avoid impulse purchases because you will be shopping less often.

#11. Negotiate Your Bills

Did you know that many companies are willing to work with their customers and offer discounts if you ask?

Don’t be afraid to negotiate your bills, whether it’s for your phone, cable, or internet services. And here is a trick to save even more. Never accept their first offer. Politely decline and ask if there is anything else. You will usually get an even better deal.

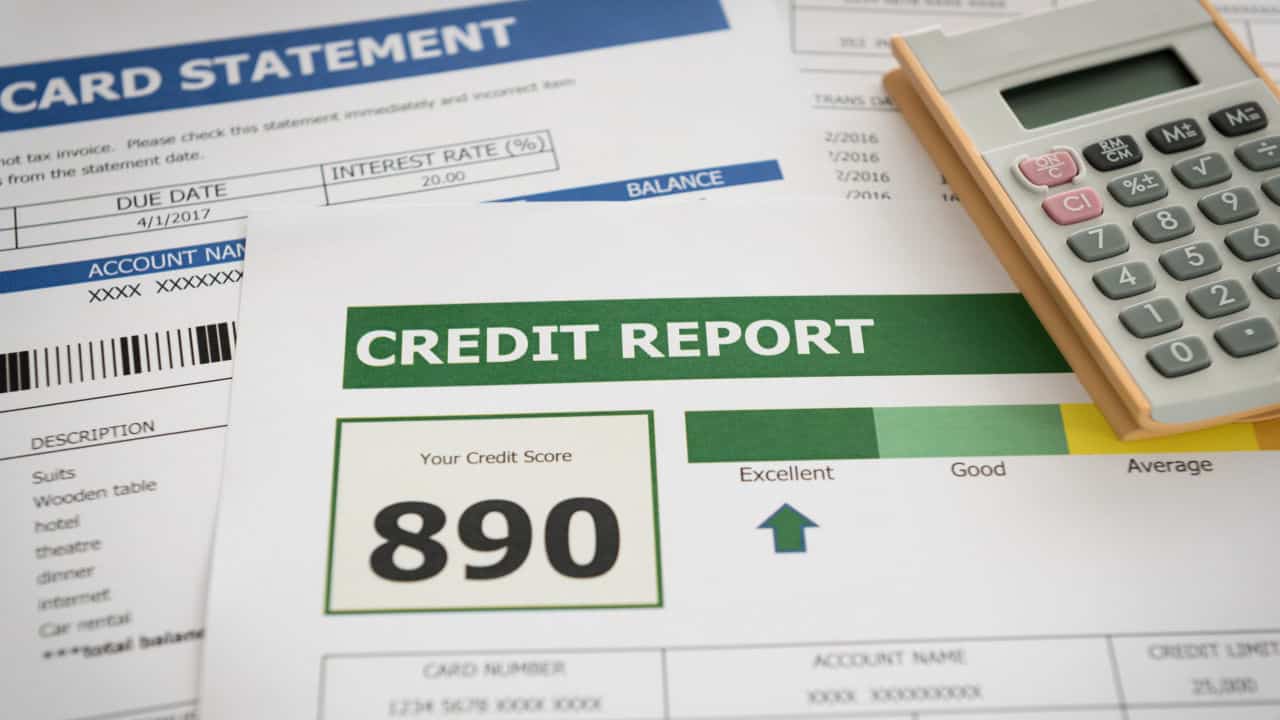

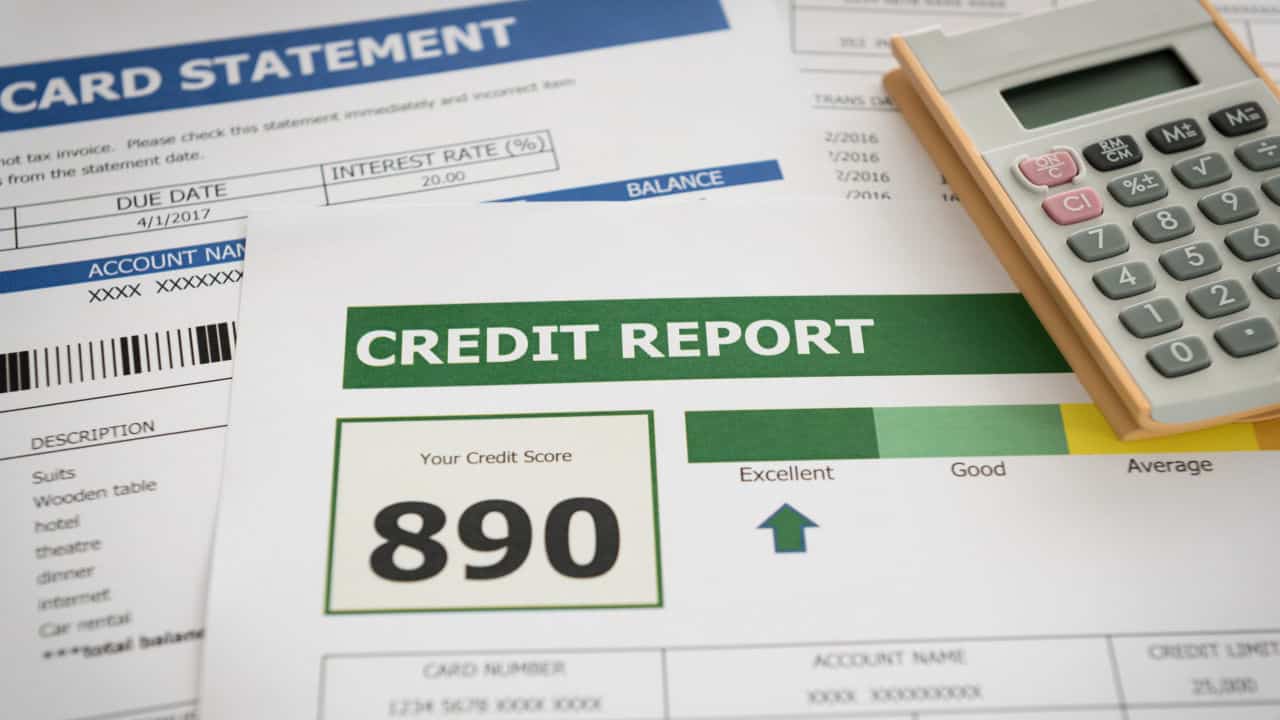

#12. Increase Your Credit Score

Increasing your credit score will save you money by qualifying you for lower interest rates on loans and credit cards.

You will definitely be happier when you see that credit score go up knowing you can potentially save hundreds or thousands of dollars in the long run.

#13. Use Discounts and Coupons

Before making any purchase, search for coupons or discount codes online for the item you are going to buy.

Websites like RetailMeNot and Honey can help you find deals effortlessly, and the savings you make can really add up if you use them on everything you buy.

#14. Swap Skills and Services

If you need your lawn mowed and you have a neighbor who is good at it, offer to help them by offering your skills in return.

This could be anything from cooking to car repairs, and it can ultimately save you both a lot of money.

#15. Use a Smart Thermostat

Heating and cooling bills take a big chunk out of our monthly expenses, but using a smart thermostat can help reduce those costs.

You can program a smart thermostat to adjust the temperature based on your schedule, so you won’t waste energy heating or cooling an empty house.

#16. Buy Used

One of the best ways to save money is buying used items instead of brand-new ones.

Whether you need a new car, a washer and dryer, or even furniture, consider looking for gently used items first.

You can often find great deals at thrift stores, garage sales, or online marketplaces.

#17. Turn Off Lights and Unplug Electronics

Leaving lights on and electronics plugged in when you’re not using them can add up to a high electricity bill.

Make it a habit to turn off lights and unplug chargers, TVs, computers, and other devices when you’re not actively using them.

#18. Go Generic

Do you always buy name-brand products at the grocery store and pharmacy?

Generic brands are often just as good as name brands, but they are much cheaper, and you do not sacrifice anything.

#19. DIY Everything

Instead of spending money on services like car washes, haircuts, or home repairs, consider doing them yourself.

You can learn how to do these tasks yourself by going online and checking out a tutorial.

You will enjoy the fun of completing something on your own.

#20. Get a Side Hustle

If you want to save money without sacrificing happiness, why not start a side hustle?

Whether selling handmade crafts, offering freelance services or driving for a ride-share company, side hustles can bring in additional income that can be used to save or pay off debt.

#21. Spend Cash

If you usually use a credit or debit card when you go shopping, try only spending cash for everything to save money.

Seeing the money leave your wallet can make you more conscious of how much you are actually spending, and if you don’t take money with you, you can’t go over your budget.

#22. Don’t Use Disposable Products

Instead of using disposable plates, cups, and utensils, invest in reusable ones that will last longer and save you money over time.

You can also opt for cloth napkins instead of paper ones, and switch to a reusable water bottle instead of buying plastic bottles.

#23. Adjust Tax Withholdings

By adjusting the amount of taxes withheld from each paycheck, you can receive more money in your take-home pay and have less of a refund at the end of the year.

You can use this extra cash to save or pay off high-interest debts.

#24. Try a Savings Challenge

Challenge yourself to a no-spend week or month.

It is a great way to reset your spending habits and to see what you can live without and what you really need.

Best Frugal Living Tips

There is a misconception that living frugally means living a miserable life.

But the reality is, most frugal people are happier and wealthier.

Here are some simple steps to start living frugally and be happier as a result.

EASY FRUGAL LIVING TIPS FOR WEALTH

How To Invest In Yourself

We all know we grow wealth by investing in the stock market or putting our money into savings accounts.

But many of us are unaware that the best returns are by investing in ourselves. When we improve ourselves, we have the ability to earn a lot more money, which makes it easier to become filthy rich.

LEARN HOW TO INVEST IN YOURSELF

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Read the full article here