Have you ever had to take out a loan? Rent an apartment? Get a rental car? Interview for a job? Your credit score can impact the outcome of each of these things. A good credit score is a tool that can help afford you more options in life, but it demands attention to achieve and maintain. To get your credit where you want it, you have to have a good understanding of the credit score system and how to make it work for you.

A Good Credit Score is a Financial Tool

How did American consumers and homeowners get to the point where they are obsessed with a three-digit number?

We live in a world where it is difficult for anyone to get anywhere in life without a good credit score. Successfully buying a home, renting an apartment, getting a prestigious job, or starting a business can all depend on that number. That being said, you should understand the system and be able to make it work for you.

Do you truly know the history of the credit score or even why it is needed in life? The credit score as we know it now was invented over 200 years ago. From the late 1800s and up to the late 20th century, the proto-credit score system was highly subjective, privacy eradicating, and kept secret from the public.

Fast forward to today, over 90% of applications for a loan are predicated on a three-digit credit score. Many people wind up feeling trapped by their credit scores. However, it should be viewed as a tool. To do this, you need to understand where the credit score comes from and how it is calculated.

What is a Good Credit Score?

A credit score is a three-digit number ranging from 300 to 850. It determines your ability to pay back a loan and quantifies your “credit-worthiness.” The average credit score today is 715. Any credit credit score between 670 and 739 is considered to be good. Between 740 and 799 is very good, while 800 and above is exceptional.

In contrast, credit scores between 580 and 669 are considered fair. While you will likely be able to get approved for loans and lines of credit at this range, it may be more difficult. You may have to find a cosigner or opt for loans with higher interest.

Scores that are 579 and below are considered poor. In this range, you’ll likely have to have a cosigner or provide the lender with some kind of collateral to be approved for loans or lines of credit.

What Impacts Your Credit?

That said, each credit bureau will have its own credit score for you. The big three are Experian, TransUnion, and Equifax. While there may be some minor differences between these three scores, they will typically be within a few points of each other.

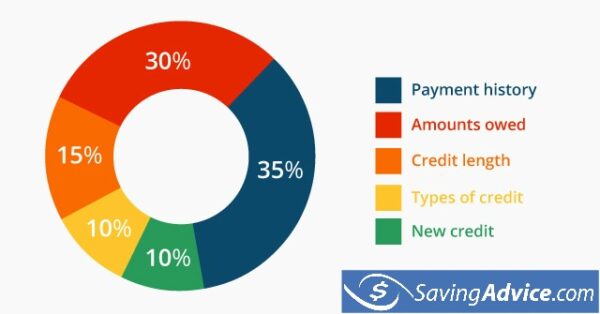

Your payment history, length of credit history, types of credit you have, outstanding balances, and how often you apply for new credit all have an impact on your score. The credit bureaus take each of these into account when calculating your score. However, each piece of the “credit score puzzle piece” isn’t cut equally. Some aspects have more of an impact than others. Take a look at the graphic below.

You shouldn’t be discouraged if yours isn’t perfect. The credit necessary to achieve your goals (like buying a home) is relative to the lender. To be approved for a mortgage loan, you’ll likely need a score of about 620. Your score can also impact the mortgage rate you will receive. So, it’s important to keep those things in mind, depending on what you are using your credit score to achieve.

While there are many local and federal government services that aid people with low credit scores, the reality is the lower your credit score, the more bureaucracy you’ll deal with. It is probable that you’ll face higher interest rates and larger down payments. At the end of the day, it is extremely difficult to accomplish your life goals without a decent credit score.

Your Credit Score in Daily Life

Your credit score can impact other aspects of your life, including being approved or denied loans. If you want to work with the military, financial institutions, or mortgage industry, they will check your credit score. Anyone who wants a government job, like working with the TSA, or is interested in getting temp work through an agency will have their credit checked, too.

At one point in time, credit card companies even kept a dystopian-caliber recordkeeping system on people. Credit card companies used to keep meticulous records of race, sexual orientation, political affiliation, social status, and other personal data along with tracking credit history. Today, these things can’t be held against you or speak to your creditworthiness, but your credit score can still have a profound impact on your life.

That said, 71.3% of Americans have a FICO score of 670 or better, earning them a “good” rating or more. As of 2022, nearly 28 million Americans are “credit invisible” or have no credit history. At the same time, only 1.7% of the population has a perfect 850 credit score.

As mentioned above, the average score in the U.S. is 715. Actually, the way people look at credit over the years has changed. In 2010, the average score was only 689. So, people are focusing on this number more. Your interest rates and even your career trajectory can be impacted by your credit.

Why is the world like this? Why is it that you, me, and anyone with future financial aspirations or business goals find their potential reduced down to a three-digit number? Also, why do we accept it?

Can You Control How Credit Bureaus View You?

Well, yes and no. You can’t control how a credit rating bureau views you, but you can control your credit score. Look at it like a financial tool to help you reach your goals. Given the above information, it can’t be denied that a good credit score is important for quality of life. However, it is crucial that you utilize it as a tool and understand the system more than anything else.

So, how do you get a good credit score?

How to Get a Good Credit Score

There is no legitimate, expedited way to improve your credit rating and get a good credit score overnight. There are several ways that you can improve your credit score incrementally if you accept that it will take time, discipline, and sacrifice. Here are some good tips for improving your score over time.

Set Up Automated Payment Reminders

Payment reminders are a great way to help increase your credit score. Remember, your payment history is a huge part of your score. Most credit problems are caused by nonpayment or late payments. By setting up payment reminders on your phone, computer, or even through your bank you can stay on top of your bills. It has also become incredibly easy to automate payments so you never miss a due date.

Keep Tabs on Your Credit Score

Federal law requires each of the three major credit reporting bureaus, Experian, TransUnion, and Equifax, to provide you with one free credit report annually if requested. Annual Credit Report allows you to request a report from all three credit agencies at once, or from one at a time.

If you get all three at once, you can compare and ensure they match. If you get them one at a time, you can check a version of your credit report at three different times during the year. You can also request your free credit report directly from each of the credit reporting bureau’s websites.

Check the perks of any of the credit cards and bank debit cards you currently use; some allow you to check your credit score regularly as a free perk. Here is a list of 9 financial institutions that offer you free access to your credit score:

- Bank of America

- Citi

- American Express

- Discover

- U.S. Bank

- Chase

- Barclay’s

- Wells Fargo

- Capital One

You should be in the habit of checking your credit score often. This allows you to keep on top of any changes and inaccuracies in your report. You can dispute anything that you see isn’t correct. For example, you might spot debts that aren’t yours or missed payments that aren’t right. These small things can have a significant impact on your score. Disputing them can help bring it back up.

You can call or write a letter disputing the error to the credit bureau(s). If you can successfully dispute an error, then you will see a relatively quick improvement in your score. Over one-fifth of cardholders who checked their reports found an error that affected their credit score.

Pay Down Your Debt

Honestly, the best way to improve your credit score is to pay off debt. You can work with a finance professional to create a plan to realistically reduce your debt. Some key suggestions are to start living below your means, prioritize needs over wants, and develop and update a monthly budget.

Having a bad credit history and unmanageable debt can automatically decrease your credit score by 20 points according to new FICO rules instituted in 2020. The new scoring method is called FICO 10 and it affects over 80 million Americans who will see their FICO score decrease due to debt or increase due to their financial history.

Get a Secured Credit Card

If you are one of the 28 million Americans who don’t have any kind of credit history, a secured credit card could help. A secured credit card requires a deposit and that deposit serves as your credit limit. So, you must pay to get and maintain your own credit limit. Then, you can make purchases or pay bills to incrementally rehab your credit score over time.

Put down a cash payment you can afford and use the card sparingly. Make sure that the cash you put down for the secured card is money you can afford not to have in your pocket. Think of it as an emergency savings account that you’ll only use if you can put the money right back.

This process could take months or years depending on how bad your credit is, but if you stay disciplined with a secured credit card, then your credit score will improve. Here are the 10 of the best secured credit cards, according to Forbes:

- Varo Believe Card

- U.S. Bank Cash+

- U.S. Bank Altitude

- Secured Chime Credit

- Discover

- First Tech Platinum

- Capital One

- Bank of America Customized Cash

- Bank of America Travel Rewards

- First Progress ($49 annual fee)

Pay Your Bill in Full

Making the minimum payment isn’t the worst thing you can do for your credit score, but it’s close. The minimum payment is the smallest percentage of your outstanding balance that you can pay without incurring penalties. Still, the remainder of the full balance will carry over to the next month and the next.

Your minimum balance will incrementally increase over time. Your interest rate might increase too. Improving your credit score will be an easier task if you always pay your bills in full and on time every month. Of course, there will be months when this isn’t a possibility, but make your best attempt to pay your credit card bills in full whenever possible.

Don’t Close Old Accounts

Don’t close your old credit card accounts if you can help it. Think about it: your oldest credit card started your credit history. Once you close those old accounts massive swaths of your history could get deleted and ultimately impact your credit score.

That said, we’ve already talked about how to get a good credit score and what the effects on your life might be. So, what are some of the other benefits of having a good score?

Benefits of Having a Good Credit Score

In today’s financial landscape, a high credit score is often viewed as a key to unlocking various financial products, particularly loans and credit cards. As you already know, the impact of a good credit score stretches far beyond the realm of borrowing. Here are some of the other perks of improving your credit score that you might not have previously considered.

1. Lower Insurance Premiums

Insurance companies often use credit scores to gauge risk and determine premiums. You can land significantly lower premiums, especially for auto and homeowners insurance. This correlation is based on the premise that individuals with higher credit scores are less likely to file claims. Maintaining a stellar credit score can mean more money in your pocket through reduced insurance costs.

2. Enhanced Employment Opportunities

As mentioned above, some employers perform credit checks as part of their hiring process, especially for positions that involve financial responsibility. A high score can portray you as a reliable and trustworthy candidate. In some cases, it can be the deciding factor in whether or not you get the job. This is particularly relevant in competitive job markets, where a good credit score can give you an edge over other applicants.

In some jobs, it can be difficult to get a security clearance with bad credit. Over 95% of employers conduct a background check, including a credit history, on job applicants. At least 16% of employers will perform a complete financial record and financial check-up on job applicants.

3. Better Housing Options

When it comes to renting, landlords and property management companies often favor tenants with higher scores. A good credit history implies financial stability and responsibility. In competitive housing markets, a high credit score can be a crucial factor in clinching your dream apartment or house. You might also discover that your credit score can impact the deposits you pay on utilities, sometimes eliminating the cost altogether.

4. Increased Credit Card Rewards

Credit card companies reserve their most lucrative rewards programs for consumers with high credit scores. These rewards can include cash back, travel points, and exclusive event access. Maintaining a high credit score not only increases your chances of approval for these cards but also allows you to take advantage of a wider range of benefits.

5. Easier Approval for Rentals and Leases

Beyond housing, a high credit score simplifies the process of renting or leasing vehicles, electronics, and other high-value items. Retailers and rental agencies view customers with high credit scores as low risk, often leading to easier approvals and more favorable terms.

6. Access to Higher Credit Limits

Banks and credit card companies are more inclined to offer higher credit limits to individuals with a strong credit history. This not only provides more financial flexibility but it can also help maintain a lower utilization ratio, which further boosts your credit score.

7. Improved Negotiating Power

With a high credit score, you’re in a stronger position to negotiate lower interest rates and better terms on loans and credit lines. This leverage can translate into substantial savings over the lifetime of a loan, making it easier to manage your debt and save money.

8. Waived Fees and Deposits

Utility companies, cell phone providers, and even landlords often require deposits to hedge against payment defaults. A high credit score can lead to these deposits being waived, freeing up cash that would otherwise be tied up.

9. Stress-Free Travel

Car rental companies and hotels frequently place holds or require deposits for customers with lower credit scores. A high credit score often eliminates these requirements, making travel more convenient and less stressful.

10. Access to Exclusive Financial Products

Some financial products, like premium credit cards and elite loan programs, are only available to consumers with excellent credit scores. These products often come with benefits like lower interest rates and additional perks, providing value beyond basic financial services.

11. Overall Financial Well-Being

A survey conducted by financial institutions found that 73% of Americans’ number one source of stress was their dismal personal finances and bad credit. A high credit score can help decrease your stress and lead to better financial health overall. You will have an improved sense of security and peace of mind knowing that your credit is good and you have that to fall back on.

With all of that in mind, sometimes we get into a spot where you can’t make your credit score a priority. It might be in the toilet. That’s okay. There are plenty of things you can do to rehab your credit score.

Anyone Can Rehab Their Credit Score

If you’ve run into a problem with your score, you’re probably looking for an immediate fix. Unfortunately, there’s no overnight fix for your credit. It will take time and you’ll want to adopt good habits to maintain all of your hard work too.

Consider this story of a small business owner who overcame bad credit and personal life experiences to find financial success later in life.

Teresa Hodge served around five years in a federal prison. After release, she had a negative credit history and a bad credit score. Hodge joined a local credit union, opened a joint account with a relative, and slowly rehabbed her credit. She now runs an organization that helps former inmates become entrepreneurs.

Taking the steps to improve your credit score can truly change your life. Hodge is proof of that.

You Are More Than Just a Number

Most credit card companies, credit rating bureaus, and lenders want you to believe that all you are, the sum of your being, is a three-digit credit score. Your current and future aspirations are all dictated by every financial decision you’ve made. Multiple credit bureaus, rating agencies, and credit history companies have a digital file on every transaction you’ve made since you acquired your first credit cards and bank loans. It’s crazy to think something you did in college might impact your credit for decades.

Now that you know more about the credit score system, how it works, and how to make it work for you, you can move forward with making improvements. More importantly, you can keep in mind that you’re more than just a number. Your score doesn’t need to define you. Remember, it’s a tool to help you get where you want to be. It’s not the end-all, be-all of your life.

Read More

Business Credit Card Perks: What’s Worth the Annual Fee?

93% of Self Made Millionaires Use Credit Cards With Reward Points

Read the full article here